Prescription Tax and Layout

The euphemism ‘wait time’ hides a truth that retail pharmacies avoid otherwise necessary investment in patients by charging a patient prescription tax. This tax transfers the burden of ‘time to do it right’ to the patient in the form of reduced benefits and delivery delays. The significance of this tax is made evident when comparing retail and outpatient pharmacy requirements for layout, process, and technology.

Overview

- Despite wait time becoming a common practice and accepted consequence, it is not a benign step in the prescription dispensing process.

- Time required for steps that someone must complete to convert inventory, mitigate patient risk, or ensure therapeutic outcome cannot be eliminated, only transferred to the patient as a benefit tax.

- Not only have drug chains been reluctant to invest in patient centric technology, but pharmacy regulations also frequently make it difficult for others, like outpatient pharmacy, to utilize technology in its most efficient and effective manner.

- Taxing patients at an outpatient pharmacy is not an option, and the risks for reduced benefits cannot be transferred to the patient.

- Drug chains would need to change layout, process, and technology to add back patient benefits at the expense of their low-cost delivery model.

Drug chain forays into patient centric pharmacy layouts were seemingly gone as quickly as they began. These layouts repositioned pharmacists for easy access to and by patients. How could a win-win patient centric layout fail to get off the ground? What does this tell us about layout? How might their experience guide outpatient pharmacy design?

The Patient Tax

The basic formula for prescription dispensing converts inventory to a deliverable good by the addition of time … more commonly thought of as labor. Time is required to convert bulk inventory according to a pre-defined process.

The pharmacy, and in the case of chains, pharmacists in management, decide how to process a scrip and how much time they are willing to allow frontline pharmacists to use. Patient wait time occurs if the time allowed is less than what is needed to satisfy immediate demand.

Despite wait time becoming a common practice and accepted consequence, it is not a benign step in the prescription dispensing process. It is not a free good in an economic sense. It has tangible value, measurable, and has risk. Yet, to most drug chains wait time may have become an essential part of the retail prescription experience and cost model.

We can categorize wait time as shown in Illustration (1) above. Process Wait Time (PWT) is the time required by the pre-defined process to complete the conversion of bulk inventory to a delivered product. In this instance, the product includes the medication, resolutions, and delivery value. Each in kind requires time to create added value.

Process Time and Benefit Tax

Drug chains have achieved a virtual monopoly of the prescription dispensing industry. Resilient demand queues made standardized low value processing possible. Observation suggests

pharmacies may not fully staff (add time) for the benefit of patients and may have stripped steps from the process that provide patient benefit. One might imagine that

any reduction in product time could harvest profit for pharmacy. But is it for pharmacy to take back?

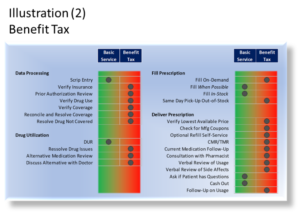

Pharmacies cannot eliminate time required for steps that someone must complete to convert inventory, mitigate patient risk, or ensure therapeutic outcome, only transferred time to the patient as a benefit tax. Illustration (2) shows the extent to which drug chains tax patients for the time needed to fully satisfy product requirements.

Understandably, retail pharmacies do not directly profit from time invested in patient benefits, or do they face financial risk by avoiding investment in time. An MD on the board of a hospital argued that “ … no pharmacy ever made a nickel consulting a patient”. In the absence of significant competition or legislation, retail pharmacies lack incentive to invest in patients.

Drug chains in particular can reduce layout requirements by removing time (steps) from process. For example, a pharmacy providing full reconciliation and resolution might expected to have space allocated (somewhere) for time to complete these steps. Space would also be needed to deliver a product with greater value to the patient.

Queue Time and Time Tax

Whereas process time gives rise to the benefit tax, queue time creates a time tax. Queue time ensures all patients receive their product at the completion of a uniform process time (UPT). If the UPT is 10 minutes, all patients receive their product within 10 minutes of submitting a prescription.

Clearly, creating a uniform process time poses significant challenges for a pharmacy. Time (staffing) must increase whenever demand presents itself to allow processing to start until time becomes available (known as a server in queuing theory). Pharmacies often borrow queue time from patients in the form of a nominal expected wait time (Ex. 15 minutes).

Wait time in excess of what might be considered nominal represents the patient time tax. Pharmacies require patients to wait for product delivery until time becomes available to satisfy the order. The more resilient a demand queue, the greater a time tax the pharmacy can charge the patient.[1]

Excessive wait time occurs when pharmacies do not fully subsidize queue time. Management (often pharmacists and/or engineers) decide how much time will be allowed to complete the prescription process. To avoid idle staff, management may calculate time (staff) based on average demand. This approach ensures that idle time is not subsidize.

The impact of understating fulfillment and/or idle time on patients depends on how the pharmacy schedules staff. The easiest way to staff is block scheduling. There are two ways to do block schedule, delivery and production.

Perhaps the more common block staff model is to schedule staff to peak delivery demand periods. The patient tax will depend on finished product availability, which in turn depends on the delivery delay benefit tax. Because production time is blocked to delivery demand, production is limited to periods of low delivery demand.

Production block scheduling can cause long wait lines because time is schedule based on production demand from non-wait drop-off and deferred production from a previous day (benefit tax). While this increases the availability of finished product for delivery, limited time is available to actually deliver the product.

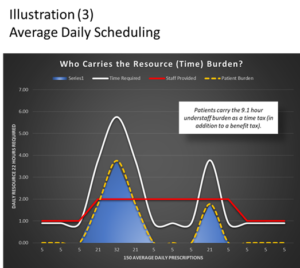

Delivery blocking time tax is shown in Illustration (3). Once again, there is a cap on total subsidized time based on average daily or weekly prescription demand and time allowed per fulfillment. In the example, management sets a daily time subsidy of 22 hours. Because idle time and productivity variances[2] are not subsidize, patients bear this shortfall as a time tax in the form of extended wait times.

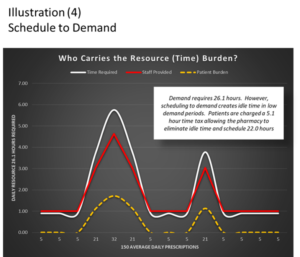

Schedule-to-demand (or delivery scheduling) mitigates the time tax only if product is available for delivery (presumably fulfilled by overnight at 24-hour locations or central fill). The time tax remains relatively unchanged when product is not available.

Product available, schedule to demand time tax is shown in Illustration (4). This illustration assumes that the pharmacy must remain open with minimum staffing at low demand periods. The consequence is that patients are taxed to keep the pharmacy open.

Limits to Patient Tax

While there are no practical limits to how much drug chains could tax patients, there clearly are limits for risk escalation. This limit was on display in 2016 when a Chicago Tribune Investigative Study revealed a concerning frequency of overlooked drug interaction consults. More alarming, perhaps, was the response of the chain dominated board of pharmacy.[3]

The value of a prescription product depends on the time a pharmacy invests in creating benefits for the patient. As we saw earlier, chains can remove this patient value as a benefit tax. Fair enough … it is a monopoly after all.

However, when subsidized time is either too low for required process time, or unable to compensate for issues in layout, process, production, or performance, critical components of the product may be sacrificed placing patients at risk for even purchasing the product. That was the case put on display by the Chicago Tribune.

Loss of the Win-Win

Drug chain forays into patient centric pharmacy layout may have been doomed from the start as changes undermined the process cost model by eliminating part of the patient tax. The increased demand for pharmacist time caused by the disruption of the production channel and add-back of patient benefits had to come from an unyielding cost model. The failure of the layout change suggests that pharmacies did not offset the loss of the benefit tax.

Layout and the Patient Tax

Higher patient taxes let retailers create cost-focused layouts to maximize profit per square foot. Stripping away time required to create product value translates to a smaller footprint, streamlined process, and even lower inventory investment.

Impact Benefit Tax on Technology

Illustration (2) shows benefits that add value to the prescription delivery process. Time and space, however, increase for each benefit a pharmacy adds to the product. In the case of data entry, technician time increases with greater patient interaction and problem resolution. Expanding data entry patient benefits require changes to LPT (layout, process, technology) to support uniform process times.

Pundits have long blamed ballooning cost/billings on hospital failure to keep pace with technology change. Like drug chains, hospitals have resilient demand queues that allow them to increase patient taxes with limited or no impact on demand for their services. The same is true for the prescription dispensing industry.

Even fifty years ago we understood the wisdom of investing in technology for the consumer. That wisdom was lost over the years as companies invested in IT and other technology to reduce cost and harvest data.[4] Drug chains are as guilty of this as hospitals as few consumer centric innovations have evolved over the last few decades. Their growing stranglehold on the industry and increasing patient tax made this disregard for consumer investment possible.

Pharmacies have not changed the fulfillment process for more than a half century that I know of. Technology and process focused on doing the same thing faster, and accommodating new payments systems, rules, and regulations. Pharmacies able to tax patients invest to lower the cost of dispensing (not passed along to the patient or payor) rather than reinvesting gains to create consumer value.[5]

Consider three technologies that would make life easier for patients that drug chains do not use.

Queue Management Technology

I always include this technology in my designs. One way to use these kiosks is for patients picking-up prescriptions to sign-in at a free-standing kiosk. This notifies the staff of their arrival. Ready prescriptions are at once called to the counter while those that may be in process are expedited. This technology allows patients to avoid waiting in line and to avoid the drop-off queue process.

Self-Serve Kiosks

This is another technology I use as often as possible. Patients pick-up and pay for refills at a self-serve dispensing kiosk. This allows patients to once again avoid long lines at the counter.

Not only have drug chains been reluctant to invest in this patient centric technology, but pharmacy regulations also frequently make it difficult for others, like outpatient pharmacy, to utilize this technology in its most efficient and effective manner.[6]

Pick-by-Light

This technology speeds up the process of picking up prescriptions by signaling the staff which bags or packages to pick. There are even cost advantages to the pharmacy to use this technology.

Impact Benefit Tax on Layout, Process and Production

Unfortunately for outpatient pharmacies, patient taxing is not an option. The risks for reduced benefits cannot be transferred to the patient. And patients have little tolerance for wait times and delays they can just as easily experience closer to home. This is one reason drug clones are not successful in hospital markets.

Let us consider a few ways the absence of a patient tax impact LPT.

Inventory

Whereas retail pharmacies could rely on patient taxes to run lean inventory[7] and standard small footprint fixtures, outpatient pharmacies must be in-stock on all staff prescribed medications serviced by innovative storage and process designs.

WIP (work-in-process) inventory is one example of how outpatient pharmacy inventory differs from the corner drug store. WIP includes a variety of multiphasic prepackaging and bundling. This inventory is stored on high velocity portable racks, overhead racks, other specialty shelving, or full vial dispensing systems.

Outpatient pharmacies face the double challenge of not taxing patients and delivering product much quicker than drug chains or the corner drug store. WIP inventory along with changes in inventory and inventory processing management help to meet these challenges.

Process and Production Channels

With therapeutic outcome and financial risks at stake, hospital centric pharmacies must engage patients on current and new medications. The double challenge here is that the engagement cannot interfere with production and delivery rates. We saw above how inventory changes contribute to queue time. Other process and production changes are needed as well.

Because benefit time can only be transferred, not eliminated, outpatient pharmacies must create process that moves the time subsidy to periods prior to on-demand delivery. This means things like insurance validation, prior authorizations, charity processing, and documentation must occur outside the production window.

Another example of how production and layout change affect how vial robotics are used by pharmacies. Some drug chains use these robotics in-line, stocked with the high frequency medications. Outpatient pharmacies, on the other hand, would create layouts that support high frequency WIP and stock robotics with low frequency medications during operating hours.

Demand Interface

Patient tax allows drug retailers to pull demand to the pharmacy at the counter (in-person, phone, on-line) or as autofill. They restrict markets to insured and cash patients. These pull devices allow retail pharmacies to charge a wait time tax[8], while continuing to allow the pharmacy to fulfill the prescription at their discretion.

Outpatient markets are more complex creating multiple demand interface requirements. This means layout, process, and technology must accommodate push demand. An example of push demand is bedside service which requires proactive processes, closed production channels, delivery staging, drop-shipping, and remote patient interface.

Drop-off/pick-up

High touch drop-off/delivery increases the frequency for time traps and interrupts which, if not addressed, reduce production channel thru-put rates. Because outpatient pharmacies cannot tax patients, layout must accommodate processes that protect production channel rates.

Outpatient pharmacies must use multiphasic production channels supported by trap sidings and eliminate interrupts at key chokepoints in the production channel. Traps sidings provide dedicated time to triage and resolve medication issues, while allowing clean orders to move uniformly into the production channel.

Retail pharmacy low touch drop-off/delivery model nearly eliminate all patient interference with the production channel at the expense of patient benefits and wait time.

Summary

Drug stores can define layouts by the degree to which the pharmacy charges a patient tax. The greater the patient tax, the smaller the investment and footprint. Drug chains have the greatest ability to tax patients owing to their market monopoly and competitive practices one might consider predatory.

Patients bear the burden and risk of benefit taxes when pharmacies strip the value of product that can only be transferred, not eliminated. A time tax occurs when patients must accept long wait times and delays in delivery of the medications caused by underinvestment in time by a pharmacy.

The ability of pharmacies to charge a high patient tax has slowed the adoption of available patient centric technology as old methods continue use at the expense of patients.

Outpatient pharmacies cannot charge a patient tax without consequence to both the hospital and patient. For this reason, the layout, process, and technology required by outpatient pharmacy is significantly different than what retail pharmacy could get away with.

Footnotes

[1] When the wait time exceeds patient tolerance for time tax, the wait time can become mandatory ex. mail order.

2] Interrupts, time traps, and social friction significantly affect production channel through-put rates.

[3] A 2016 Chicago Tribune investigation found significant counseling issues in 52% of chain drug pharmacies. The Collaborative Pharmaceutical Task Force, met to review public risk and proposed legislation, by-passed the issue in concluding that a 30-minute meal period would solve the failure to counsel issue.

[4] Retail interruption during the 2020 COVID-19 pandemic forced many sellers to add back consumer value and benefits in the delivery of goods. Less real add back was observed in monopolized drug dispensing industry.

[5] Observation informs us that despite cost saving technology (robotics, computers, etc.) patients continue to carry the burden and risk of low benefits and high wait time. One could argue, though, it would be a lot worse if cost savings had not occurred … except that chain drug profits continued to rise.

[6] Despite hospital secure floorplans, regulations require some technologies physically attach to a pharmacy. While it is true that such restrictions must exist at the corner drug store, the many secure locations within a hospital and on campus make this regulation arbitrarily obstructive and anti-competitive.

[7] The ability to charge a patient tax allows pharmacies to reduce investment in inventory by allowing out-of-stock, special orders, and other avoidable delays with on-demand filling.

[8] While potentially reducing pick-up wait time, this pull device requires patients to anticipate and invest time to place orders in advance to allow chain drug pharmacy avoid investing in new processes or subsidizing time which would be necessary for on-demand delivery.