Does the Future Retail State Include Pharmacists?

The future state for retail pharmacy does not include pharmacists unless retailers can find someone willing to subsidize them. The fact is the number of days for retail pharmacists as we know them may be growing shorter. Retail pharmacist management have long denied front-line pharmacists healthcare value by harvesting Rph-Patient time for profit. Now they are at a crossroad.

Overview

- There would be no need to ‘free up’ pharmacists today if retailers had applied technology to ‘free up’ staff in the past.

- Any significant increase in the RPH-Patient time ratio can only come from an increase in the number of pharmacists at stores.

- Regulations are the only barrier to eliminating retail pharmacist.

- Chains provide patients with extensive drug information to complete DUR and self-counsel on new drugs.

- Robotic technology is available to significantly reduce reliance on store staff, including the pharmacist.

- Business models find alternatives to costs that cannot be sustained.

- Chains will downsize stores to serve solely as prescription ‘kiosks.’

In early 2018 I suggested a potential future state for pharmacy. It reflected a transformation that focused on patients. It improved population health by empowering the pharmacist as a more central figure in healthcare. Hospitals could leverage their already substantial investment in pharmacists to reduce costs and increase profitable revenues in other departments. This was the future for hospital-centric pharmacy.

There is another future for retail pharmacy. This vision is much different and further diminishes the role and need for pharmacists. Drug chains continue moving towards this alternative retail state. Even as chains tout recent technology to ‘free’ up the pharmacist to serve patients, the future for retail pharmacist grows dimmer.

Over seven decades I have seen a lot of frogs boiled in a pot of water.[1] They never saw, or believed, the end was near. Below are some boiling points.

Boiling Point: How Credible is the Claim to Increase RPH-Patient Engagement Time?

Probably, not very. It is a pretty fair assumption that chain retail pharmacists spend almost all of their time satisfying enforceable licensed tasks given all the pushback on workload. That means any significant increase in the RPH-Patient time ratio can only come from an increase in the number of pharmacists at stores.

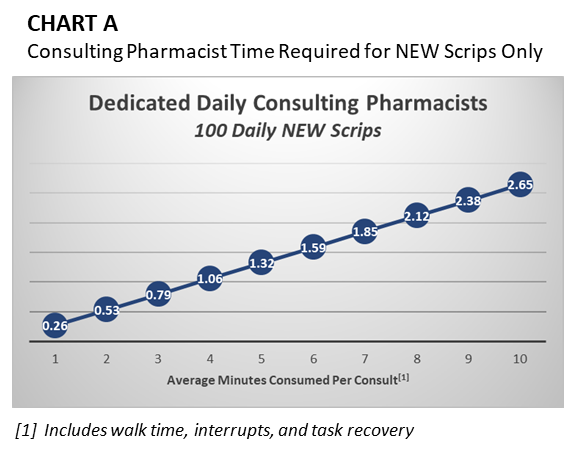

The number of additional pharmacists required just to counsel patients on NEW drugs is shown in Chart A. The chart assumes one-hundred new prescriptions a day associated with an average 250 scrips store.

Make sure to include total interrupt time when reading the horizontal axis. For example, while the actual consult time might be 3 minutes, total interrupt time could be 1-2 minutes higher. Also remember that interrupt time increases with scrip count.

It is a fair assumption new scrip total interrupt time averages 4-5 minutes. This means that chain drug stores would need to dedicate 1 to 1.3 pharmacists for new scrip counseling alone. The number is likely higher given the bimodally distributed patient curve.

Another thing to keep in mind is that counseling is not the only thing that pharmacies need to correct. DURs , for example, are incomplete because patients are rarely, if ever, asked to verify the medications they are on whenever picking up any medication, let alone new prescriptions.

Boiling Point: The Myth of Technology

There would be no need to ‘free up’ pharmacists today if retailers had applied technology to ‘free up’ staff in the past. The simple fact is that return on task technology investment requires a reduction in labor cost. This means chains might have reduced staff, eliminated shift overlaps, expanded tech-to-pharmacist ratio, and closed pharmacies for lunch. They may even have delayed adding pharmacists as prescription count grows to reduce cost per scrip.

Pharmacy schools nurture students dreams to serve patients and conduct a professional health care career. While that may be true for entrepreneurs, it is decidedly less true at major drug chains. The bottom line is the sole goal for retailers. As in any profession, specialty skills are only valuable if someone is willing to pay for them. As it turns out, no one is.

Regulations are the only barrier to eliminating retail pharmacist. The self-imposed rules serve to protect the interests of certain retail players depending on the independent-to-chain mix of board members. Even so, the role of pharmacists has been decreasing the past few decades as chains look to de-regulate pharmacist task in favor of lower cost labor and technology.

Boiling Point: Drug chains reduced store staff requirements by diverting tasks to central services and fill centers.

‘Outsourcing’ pharmacist and technician work helps maintain lower store staff levels than might otherwise be necessary to support all prescription activity. Chains can harvest labor savings as profit.

Central fill and services are still touted by vendors as a means to free up the pharmacist, just as the addition of these may have been presented by retailers. Had this been the case, however, current store staffing would likely be higher than it is and pushback on workload would not exist.

Boiling Point: In-market central service hubs provide a way forward for retailers.

The fallacy of central fill extends to new distributed fill facilities. These new local hubs require a reduction in cost to meet ROI requirements. With shortages in technician and pharmacists, these chains must find other ways to eliminate store labor.

Local service hubs have been on the table for some time. The challenge has been technology. Robotics are now capable of handling multiple product packaging. This paves the way to significantly reduce reliance on store staff.

Boiling Point: Technology has rarely improved pharmacist-to-patient time over the past 40-50 years.

The simple fact is that there is no profit in counseling patients. An MD on a board of directors in New Mexico argued against pharmacy transformation stating that ‘no pharmacy ever made a nickel counseling a patient.’ Drug chains have long since harvested the cost of counseling patients to increase profit. One only needs to observe the lack of pharmacist visibility and engagement to support this assertion.

Boiling Point: Retail pharmacists do not play a critical or irreplaceable health care role today.

You do not need a buggy whip if you do not have a horse. Nothing the retail pharmacists does today cannot be done more efficiently given a change in the business model. Consider these few changes making store level pharmacists less essential:

- Counseling depends on your answer to this conundrum question: “Do you have any questions for the pharmacist?” Ask this way, pharmacies avoid staffing up pharmacists for patient counseling.

- Pharmacists go through the motion of DURs that are incomplete and give a false sense of safety. Pharmacies rarely, if ever, confirm patient medications before filling a new or refill prescription. Patients receive extensive drug information and must complete their own DUR and self-counsel.

- Computers can perform DURs much more reliably and accurately than a pharmacist. They can be programmed to provide a more uniform and exceptional response.

- Some states allow a second technician, rather than a pharmacist, to verify the work of another technician.

- Technology is available for virtual final product verification.

The fact is that IF pharmacist-patient time increases, it will do so with a geometric effect. Counseling will require the pharmacist (or should) verify all patient medications. This should give rise to a therapeutic review. It should also lead to options for better pricing. Just to name few.

Boiling Point: Pharmacist compensation is not sustainable.

Salary.com reported the median Illinois pharmacist cost retailers $1.72 per minute in 2022. The pharmacist shortage is sure to push this cost to an unsustainable level for the current retail business model.

Unless chains are able to convince the government and payers to pay for ‘value’, that for all practical purposes they have been doing without, retailers will need to look towards a business model that further consolidates labor.

Does the future retail state include pharmacists?

Drug chains have, for the most part, painted themselves into a corner. Legislatures and the FTC are in no small part complicit in the possible demise of the pharmacist by allowing chains to choke out competition that might otherwise have preserved the pharmacist-patient relationship.

The retail pharmacist future boils down to one of two possibilities. First, someone must step forward to pick up some or all of their current cost. Second, retailers will, or are, pursuing a future with significantly less reliance on pharmacists.

How can retail reduce dependency on pharmacist?

All that really remains is re-organizing the fill and delivery model and deleting a few lines of regulations. This should not be an issue since most pharmacy boards are dominated by drug chains.

Retail Requirements

Retailers have access to all the technology required to support the virtual pharmacist future state.

Fill all product formats with in-market central production facilities to minimize delivery cost

Robotics have advanced sufficiently to handle many product formats with machine capacity to fill average store prescription demand. Low cost to output ratio and a small footprint make these new robots ideal for in-market production centers.

Centralize inventory

Store inventory must move to production centers to prevent duplication of drugs, storage, and management. This has the added benefit of improving cash flow and reducing working capital.

Sync delivery to production cycles

Excessive in-store wait times already provide a foundation for limiting pick-up times to a production-centric fill and delivery cycle. The in-market production centers provide delivery cycle flexibility not available at large remote central fill sites.

Provide virtual counseling

QR codes stamped on prescription pamphlets will provide patients with in-store or smart phone access to a virtual pharmacist.

Low-cost prescription pick-up locations.

A hub-and-spoke store market delivery format allows retailers to expand in-market delivery presence. Available self-serve kiosks will lower the cost of delivery and allow for retailer co-tenancy.

Provide options for urgent fills.

Hub stores will continue to provide on-demand urgent prescription fills. Patients will pay a surcharge for on-demand non-urgent fills.

And there you have it … a roadmap to the future state wherein retailers relegate today’s pharmacists to history just as the 1950’s pharmacist who took care of a neighborhood’s healthcare needs … and served you ice cream while talking to your mother about medication or other health care concerns.

Footnotes

- Refers to the adage that if you put a frog in boiling water, it will immediately jump out. But, if you put the frog in the water before you boil it, it will not jump out.

About the Author

Sabrina Hannigan is a retired major drug chain executive with over three decades experience in site analysis and operations optimization. Upon retiring, she contracted with a healthcare consulting firm to consult on a broad range of operational topics specific to build-out of an outpatient pharmacy service.

Sabrina Hannigan is a retired major drug chain executive with over three decades experience in site analysis and operations optimization. Upon retiring, she contracted with a healthcare consulting firm to consult on a broad range of operational topics specific to build-out of an outpatient pharmacy service.

As an independent consultant, Sabrina recognized that retail solutions were not transferable and created an outpatient pharmacy business model incorporating methods and processes experienced over forty years in manufacturing and retail.

Sabrina is passionate about the future of healthcare and envisions hospital-centric solutions for improving therapeutic outcome and population health. Towards this end, she continues to develop new processes and methods for outpatient pharmacies.