Maximizing Prescription Revenue

Capturing Discharge Prescriptions – WAR

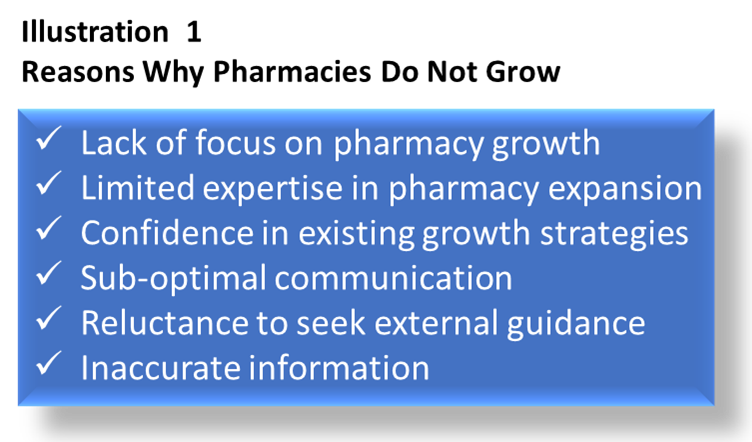

Hospital systems are forfeiting significant revenue during a critical period that demands financial strength and strategic defenses against rising retail competition. The underlying causes remain uncertain, though Illustration 1 outlines some potential factors contributing to the underperformance of hospital outpatient pharmacies. It is possible that key decision-makers, including hospital CEOs, CFOs, and Board Members, are operating on flawed information.

One of the leading reasons outpatient pharmacies do not reach their full potential is the absence of a focus on growth. In contrast to the past approach of actively engaging local doctors to generate demand, pharmacists at mega-chains are now primarily concerned with servicing patients who approach the counter. Retail pharmacists and recent pharmacy school graduates are generally not the ideal candidates for spearheading pharmacy programs in hospitals that aim to maximize their full potential. This is the reason drug chain outpatient pharmacies so often fail in the absence of conditions that force patients to use their pharmacy.

Even with the potential for significant unrealized profits, it is rare to encounter a VP of Pharmacy or pharmacy director who believes they require assistance, much less actively seek it out. One might question whether the situation would differ if top management were aware of the existing financial potential.

Among the various obstacles to creating a successful outpatient pharmacy, improving communication may be the most straightforward way to enhance performance. Several years ago, an evaluation was conducted on an Amita Health outpatient pharmacy brochure to identify its areas for improvement. Today, the focus will be on the WAR strategy, which stands for Willing, Able, and Ready.

Retailing the Hospital Pharmacy

Before delving into the strategies for cultivating willing, able, and ready customers, it is essential to tackle a common misconception: that retailing is a term to be avoided. The reality is that hospitals engage in retail practices and employ various retail methods to achieve top-of-mind awareness among consumers. While they may not excel in retailing, it does not change the fact that they are part of the retail landscape, and all hospital staff benefit from retail strategies.

Irrespective of personal perceptions about one’s professional worth, the true measure of value is determined by someone’s willingness to pay for it. If there is no willingness to assign a monetary value to either the individual or a specific set of skills they possess, then by that metric, no value exists. The necessity to effectively market oneself to establish value is universal, applicable to roles ranging from healthcare professionals to airport shoe-shiners.

Outpatient pharmacy is unlike other hospital services in that its value depends on consumer choice, not the necessity of service. Pharmacy is long associated with drug store retailing from independents to mega-chains. Without disruption, outpatient pharmacy’s reputation is inextricably tied to these precedents. Differentiating the outpatient pharmacy product with traditional retail pharmacy requires changing consumer behavior, the domain of retail marketing.

Comparison is often central to a consumer’s non-urgent decision-making. However, consumers do not always compare products before choosing. They need to have a reason for comparison buying. Brand loyalty can be very difficult to overcome without creating questions of value, reminding consumers of experiences, or changing pre-conceived beliefs about the need to get their prescription where other medications are also purchased.

Engaging in retail marketing is not only permissible for outpatient pharmacies, but also essential and anticipated by consumers.

The Willing Patient

Major chains dominate most markets with their easily accessible locations. Their well-established brands and historical reputation as go-to places for prescription services present formidable challenges for independent and outpatient pharmacies to surmount. Overcoming, however, is essential to success.

Even with the drawbacks commonly linked to drug chains, patients remain “willing” to utilize their prescription services. Customers have grown tolerant of issues like delays, lengthy wait times, and stock shortages, as well as suboptimal healthcare service. Attracting a customer who is unaware of better alternatives can be a challenging task. Drug chains continue to leverage this consumer mindset to their advantage.

Patients typically come to the hospital planning to fill their prescriptions at their usual locations. To capture this business, hospitals need to shift this consumer mindset, ideally before patients arrive for their care. If that window is missed, the mindset-altering process should commence the moment patients walk through the hospital doors and continue until they depart with their medications.

Disruption Triggers

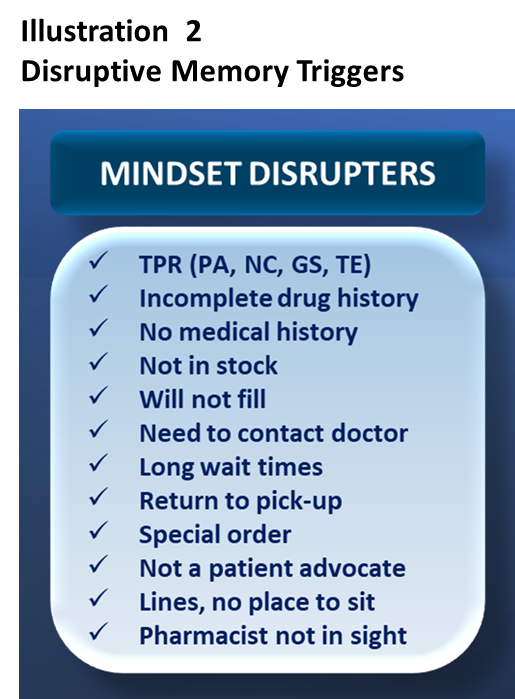

One advantage is that drug chains present numerous potential points of disruption. In retail terms, these are known as ‘fear of loss’ drivers, which emphasize the potential issues patients could face if they do not leave the hospital with their medications. These scenarios are not merely theoretical but are events that often take place at retail drug stores.

Highlighting patients’ probable past experiences with retail pharmacies serves as an effective initial step in encouraging them to explore other options. This approach communicates that they have alternatives to the traditional drug store experience and that the hospital can provide a different, potentially better, service.

The target audience for cultivating willing consumers extends beyond just the patients to include family members and caregivers. It also encompasses former patients and their families who might have missed previous opportunities to use the outpatient pharmacy. Therefore, marketing efforts should be made to reach these additional groups as well.

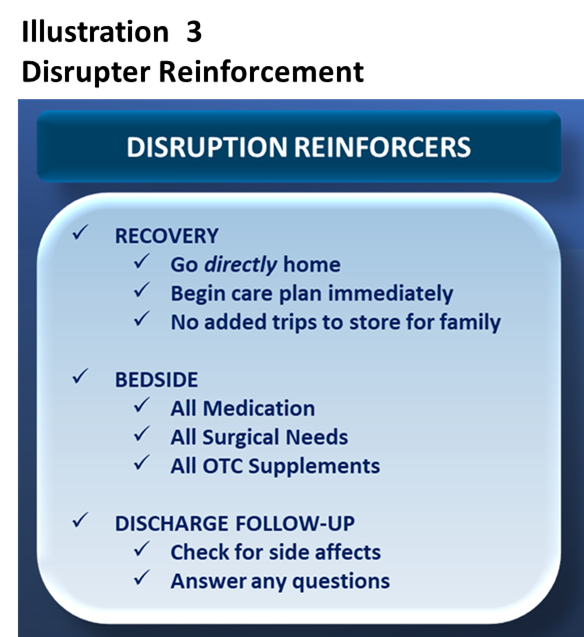

Reinforcing Disrupters

The focus is not on disparaging competitors without providing a superior product, even though such tactics can occur in the retail landscape. Assuming they are properly designed, outpatient pharmacies offer significant benefits to patients. While initiating consumer inquiry through reminders of past experiences or highlighting potential risks can be a starting point to consider using a hospital pharmacy, the strategy will be more effective when disruptive triggers are combined with positive reinforcement of outcomes.

Market Touchpoints

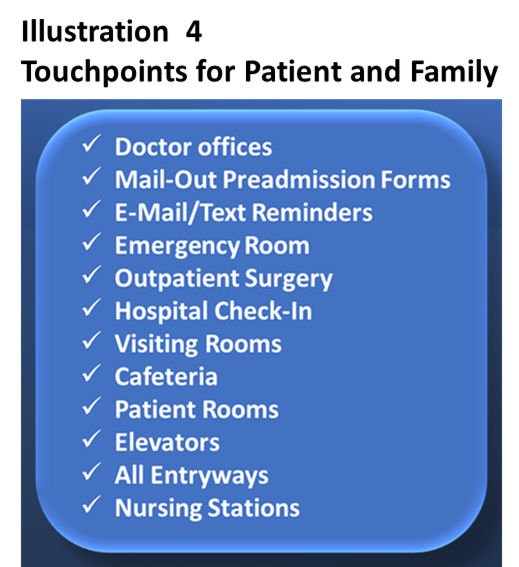

Many hospitals do not adequately promote their outpatient pharmacies, despite offering a valuable service for patients and their families. Effective reach into these target markets involves frequent and emotionally resonant messaging. Unfortunately, the most common exposure patients and visitors often get is a simple directional sign on a directory, which could easily be interpreted as pointing to a pharmacy meant solely for hospital use.

As a former retailer, I am of course inclined to saturate a market with messaging. This would work very well for hospitals and, done in a manner consistent with the professionalism of the staff, produce the best results. Illustration 4 lists some of the key patient, family, and staff touchpoints. With respect to the latter, staff need to get the message as well. Without their active engagement in creating a willing, able, and ready consumer, there is little chance for success.

The message and media used at the above touch points must be compelling as well. The Amita Brochure was not compelling. The in-room message and media in the example below was equally not compelling from firsthand experience.

The Able Patient …

Hospitals must be proactive to ensure patients are able to pay for their medications, by cash, insurance, or financial assistance. Ideally this process begins at clinics and doctor’s offices with signage, brochures, take-home material, even verbal engagement when planning a visit to the hospital.

Ensuring that patients can pre-pay or pay at bedside using credit or debit cards is crucial for hospitals. The payment method should not act as a barrier to obtaining medication promptly upon or prior to discharge.

Outpatient pharmacies and/or administrative services should proactively check on patient ability to pay. This will play into the process to ensure they receive their medication in a timely manner.

The Ready Patient …

Outpatient pharmacies need to take the additional step to ensure a patient is ready for a prescription fill. Drug stores do not need to worry about this because they are not required to provide a prescription on-demand. It will take however long it will take and patients simply must wait or not fill their prescription orders.

Ensuring a patient is ready means completing every task that can be performed before the patient’s order is received. This involves a process called “out-cycling” and can be found on my website. Briefly, the process involves completing a prescription record for patients as data is collected prior to, or after admission. These records are staged and ready for upload to the main prescription system when the order is received.

Readiness affects the prescriber and staff as well. The sooner an order is made the better the pharmacy will be able to react to it. A desktop system or daily report on prescriber behavior will focus on where an improvement is lead time is required.

Gateway Locations

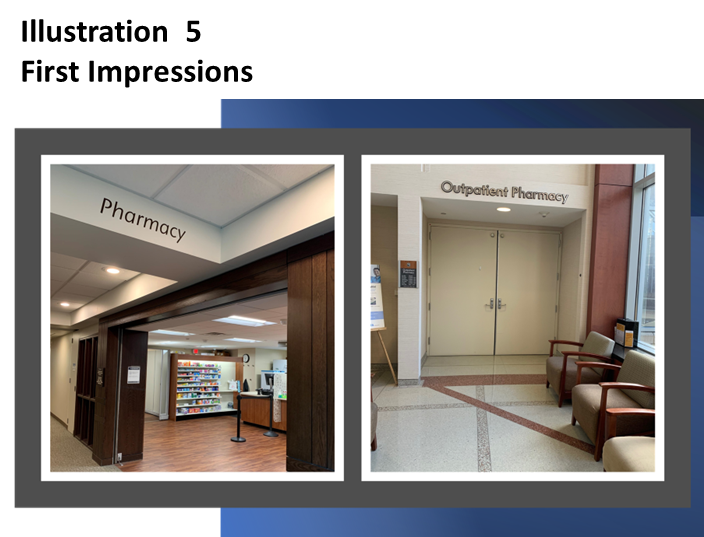

Gateway locations provide high top of mind awareness to the existence of patient pharmacy services. Usually, one can judge how serious a hospital is about serving their patient’s prescription need and capturing the total market. That is not always the case.

But just having a gateway pharmacy is not enough Two gateway locations are shown in the photographs above. The pharmacy serving a 329-bed hospital is part of a larger investment that includes 68 pharmacies as well as a mail-order facility. It occupies over 500 square feet of space. The other pharmacy is associated with a 75-bed hospital and occupies around 1500 square feet. Both are conveniently located either across from or adjacent to elevator bays.

The 75-bed outpatient pharmacy shown on the left in the above photograph is very successful in capturing its market. The one on the right has little chance of capturing its full market potential.

Download PDF

About the Author

Sabrina Hannigan is a retired Walgreen executive with over three decades of experience in labor, location, layout, and operations. She consulted HURON Healthcare and clients on outpatient pharmacies.

Sabrina Hannigan is a retired Walgreen executive with over three decades of experience in labor, location, layout, and operations. She consulted HURON Healthcare and clients on outpatient pharmacies.

Sabrina recognizes retail models are not transferable to the complex hospital markets. She created outpatient pharmacy business models incorporating methods and processes experienced over 50 years in manufacturing retail, and consulting.

Sabrina envisions hospital-centric solutions improving therapeutic outcome and population health. Towards this end, she continues to develop new processes and methods for outpatient pharmacies.